Owning a business requires more than a quality formal education that will empower you with knowledge and an understanding of the working of a business. But for your business to start you will require capital to help it take off and grow. There are various methods you can adopt to acquire the capital. You should research your options thoroughly before drawing a conclusion, and here are some options to get you started.

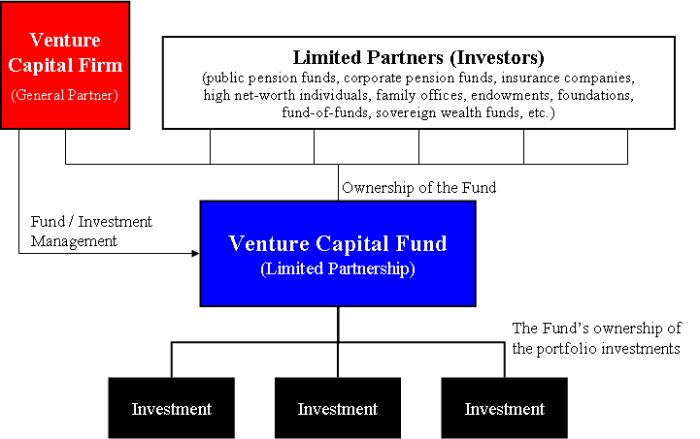

Venture Capital is one of the options that you can go for. When startup companies having high growth potential need a certain amount of investment, wealthy investors invest with a long-term growth perspective. This investment is dubbed as Venture Capital and the investors are Venture Capitalists. It is a kind of private equity. Such a venture is risky, but the returns and benefits are equally impressive.

In general, there are three kinds of venture capital. One is Seed Capital that is invested at the startup stage. Seeding capital also is a small amount that an entrepreneur receives for the purpose of being eligible for a start up loan. After this, we have early-stage capital, which includes capital for business in their first or second stages of growth. After this comes expansion-stage capital and this is for companies that are experiencing rapid growth.

Another option that can be useful to you is Crowd Funding. This is a practice of funding a project or venture by raising financial contributions from a large number of people. It is generally described by experts as “the practice of raising funds from two or more people over the internet towards a common service, project, product, investment, or cause.”

There are three parties involved in Crowding Funding. First, we have the initiator of the project. Second of all, we have the group/individual supporting the idea and lastly a moderating organization that brings all the parties together.

Crowd funding has two kinds, one of which is Reward Crowd Funding. In this investors pre-sell a product/service to launch a business while avoiding debt or risking equity/shares. The other kind is Equity Crowd Funding, in this kind of funding a share of the company is given to the backer.

This kind of funding has been proven to be beneficial. The Crowd funding industry saw a substantial growth of over $5.1 billion worldwide in 2013. The most recently successful crowd funding story was from November 2014, where Star Citizen, an online space trading, and combat video game, was stated to have raised USD $61,000,000 through Crowd Funding.

A startup can end up using a combination of the above depending on its stage of growth and capital needs. There is no single optimal type of startup capital and it is crucial that entrepreneurs analyze the distinguishing factors of each of these capital routes and determine what’s most beneficial for their needs. Raising capital is a critical component of the startup life and requires a certain level of preparation and rigor for it to be successful.